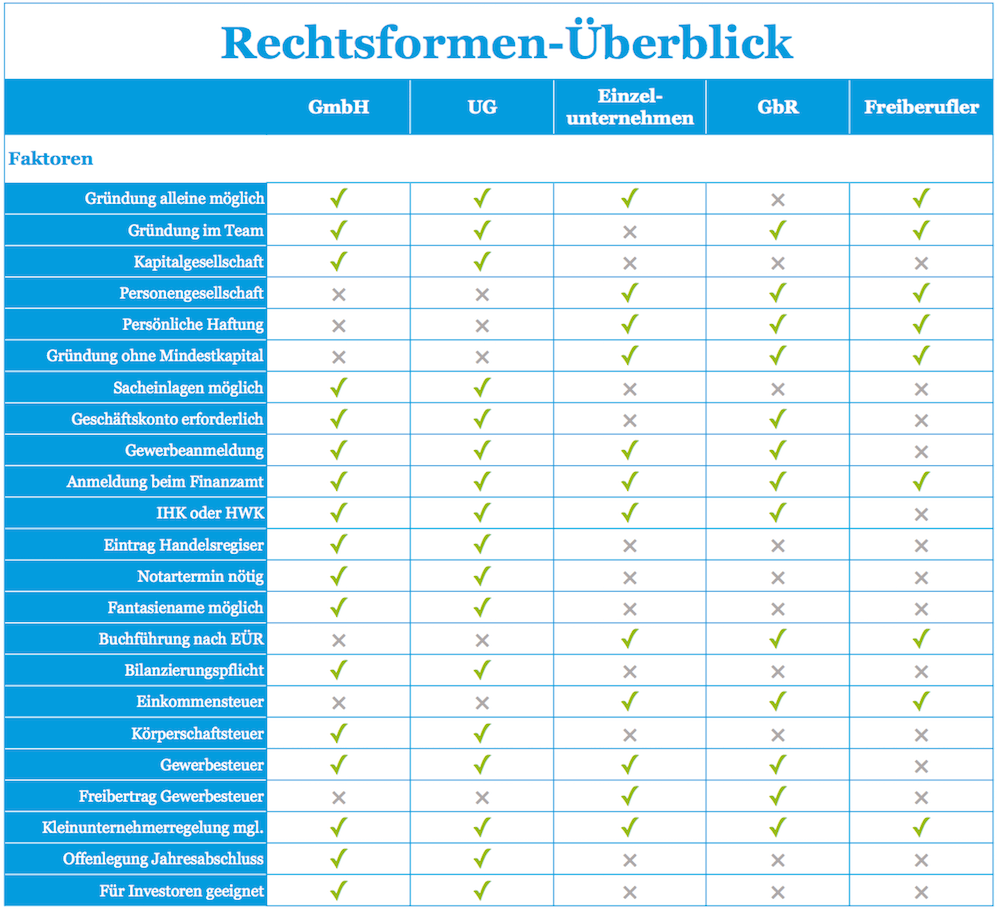

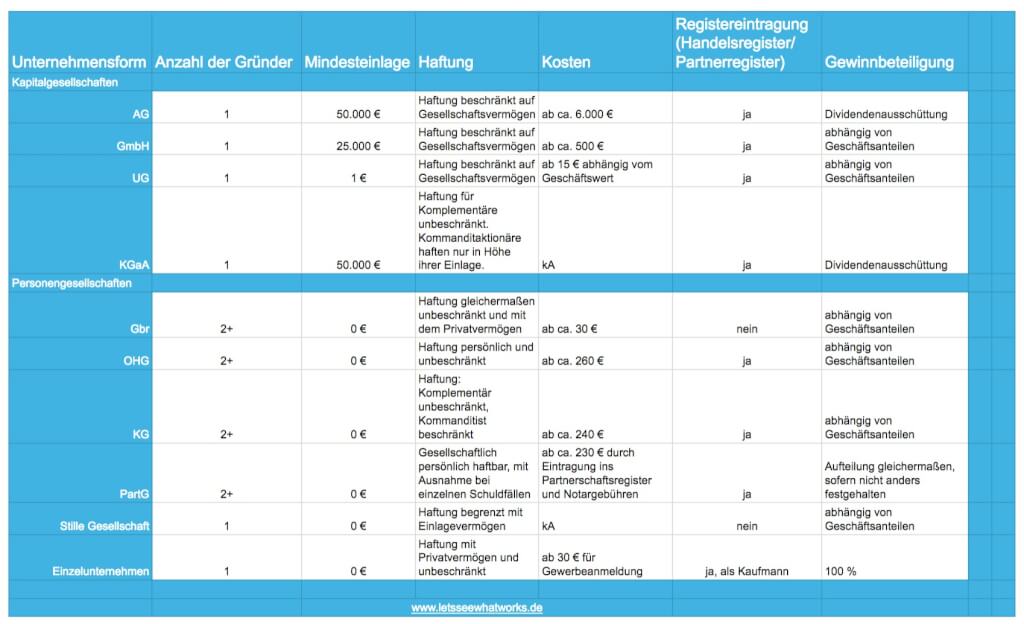

You want to get into entrepreneurship but not too sure about what company type you want to register in Germany

Like with everything else, there are numerous company types in Germany and this can get quite confusing. Not sure which one works best for you. Here’s a comparison.

Contents

Individual Entrepreneurs (Sole Proprietorship)

In Germany, the sole proprietorship is owned by one person and has no partners. With this type of business, the owner carries all the liability for the business, meaning what is earned in the company is considered their income. Usually these are registered in the name of the holder and registering in the register of companies is optional. The proprietor in this case has full liability.

The different types in Germany are:

-

Kleingewerbetreibende (manufacturing/trade)

These are people who have a company that produce or sell stuff. In this case you will need a trade permit (Gewerbeschein) from your local Trades Office (Gewerbeamt). With a Gewerbeschein you will be obligated you to pay local trade tax (Gewerbesteuer) and required to become a member of the local Chamber of Commerce (Industrie- und Handelskammer – IHK) and to pay a yearly membership fee to them.

Registration into the commercial register (Handelsregister) is optional, however, if you decide to register then you accept the same rights and obligations as the eingetragene Kaufleute.

-

Freiberufler (Freelancers)

As a freiberufler you only need to apply for a tax number (Steuernummer) at your local tax office (Finanzamt). The tax office (Finanzamt) decides whether your profession can be considered under freiberuf or as a Gewerbe.

Some of the professions that fall under this category include:

- Katalogberufe as recognized by the Income Tax Law (Einkommensteuergesetz (EstG § 18)), are those who have academic training in the following fields:

- Healthcare professions – doctors, Dentists, Veterinarians, Naturopaths, Dentists, Physiotherapists e.t.c

- Legal, tax and financial advisory professions – Lawyers, notaries, auditors, tax consultants, tax representatives e.t.c

- Scientific/technical professions – surveyors, engineers, architects, pilots e.t.c

- Language and information-conveying professions – journalists, photojournalists, interpreters, translators etc.

- selbständig ausgeübten Berufsbilder as recognized by the Partnership Companies Act (Partnerschaftsgesellschaftsgesetz (PartGG))

- psychologist

- massage therapist

- midwife

- professional appraiser

- Tätigkeitsberufe that may also be considered freie Berufe are writers, artists, performers, independent consultants e.t.c. These again have to be approved on a case by case basis by the Finanzamt.

-

eingetragene Kaufleute

Individuals registered as ‘eingetragene/r Kaufmann/-frau’, abbreviated as ‘e.Kfm./e.Kfr.’, may register their sole proprietorship using a company name instead of their own name. Are subject to German trade law (Handelsgesetzbuch (HGB)) and are obliged to maintain double-entry bookkeeping (including balance sheets).

Partnerships

Generally partnerships are grouped into 2 major categories depending on the level of liability the members enjoy i.e.:

- General partnerships: partners have full personal liability

- Limited partnerships: partners have limited personal liability

General Partnerships

Gesellschaft des bürgerlichen Rechts (GbR) = eine BGB-Gesellschaft

It is a formless contractual agreement made in order to pursue a joint business. The agreement can be made by a simple handshake and registration is not required. Are subject to the civil law ( Bürgerliche Gesetzbuch (BGB)).

Partners have equal rights and duties to carry the business; each member is an agent of the partnership.

The GbR is a partnership of sole proprietors i.e. the individuals have full liability and for paper work is done by the individuals e.g. for a trade GbR, the partners each separately apply for the trade permit (Gewerbeschein) and for a company of freelancers, the partners each apply for the tax number (Steuernummer).

Partnerschaftsgesellschaft (PartG)

The PartG is a form of the GbR that is used only by freelancers that join together, e.g. for lawyers that come together to start a law praxis. However, unlike the GbR, the PartG has a formal partnership contract (Partnerschaftsvertrag) and is registered in the partnership register (Partnerschaftsregister).

Although all members share unlimited liability, the Partnerschaftsvertrag allows for the members to agree on how this liability can be shared. For example, it can be stipulated that only the partners who were involved in the case that resulted in the loss, are liable.

Offene Handelsgesellschaft (OHG)

The OHG is a partnership whose business purpose is commercial enterprise. The firm consists of a minimum of two members i.e an individual or a legal entity. When the OHG is made of only one legal entity, this should be clearly specified in the name e.g. Müller GmbH & Co. OHG.

Partners define their mutual rights and duties by contract (internal relations). Each single partner is authorized to manage the firm, to represent the partnership, and to close contracts (external relations)

Limited Partnership

Kommanditgesellschaft (KG)

A t least one partner is registered as the general partner (‘Komplementär’), who is authorized to run the firm and who has an unlimited liability extending to his or her personal assets, while the other is the limited partner,(‘Kommanditist’), who is not involved in the operations of the firm but whose liability extends only to his or her nominal holdings in the firm. The limited partner is only liable to the extent of their contributions to the partnership’s capital, while the general partner is fully liable.

Gesellschaft mit beschränkter Haftung und Kommanditgesellschaft (GmbH & Co. KG)

A sub-type of the limited partnership where the general partner is a limited liability company instead of one person. This sub-type is also suitable for SMEs.

In this case, the GmbH is the general partner (‘Komplementär’) that carries liability for the firm while the limited partner,(‘Kommanditist’) is the individual. The managing directors (Geschäftsführer) of the GmbH manage the GmbH & Co.KG and represent it.

Unlike the Komplementär in the “normal” KG, who has full personal liability, the Komplementär in the GmbH & Co. KG, i.e. the GmbH can only carry liability to the extent of its assets. Although, this saves the Geschäftsführer from taking up liability, most banks will usually ask for the Geschäftsführer to sign a liability agreement, before issuing a loan.

Unternehmergesellschaft mit beschränkter Haftung und Kommanditgesellschaft (UG & Co. KG)

Similar to the GmbH & Co.KG, i.e the UG becomes the general partner (‘Komplementär’) and the individual becomes the limited partner,(‘Kommanditist’). The only difference here is the nominal capital required. The UG starts at 1 euro.

Partnerschaftsgesellschaft mit beschränkter Berufshaftung (PartG mbB)

This is a form of PartG that allows for limited liability for the partners involved. However, in this case the partnership requires to have a liability insurance (Haftpflichtversicherung), which in turn determines the level of liability.

Everything else is the same as for the PartG.

Corporate Enterprises

Unternehmergesellschaft mit beschränkter Haftung (UG)

It is a start-up model designed to make the formation of a private limited company easier and less risky for entrepreneurs, and to improve the international competitiveness of the German GmbH. This type of German company is also known as a ‘mini-GmbH’ or the ‘1 euro GmbH’.

An UG may be started up with only 1 euro and then, year-by-year, 25% of its profits are deposited until a 25,000 EUR share capital has been accumulated.

Gesellschaft mit beschränkter Haftung (GmbH)

This is a limited liability company, like the Limited (Ltd) companies back home. The owners of the company i.e. shareholders are not personally responsible for the company’s debts. This company requires a minimum nominal share capital of 25,000 EUR.

A GmbH must appoint one or more managing directors (Geschäftsführer), who may also be shareholders of the company and are the only persons entitled to represent the company. If a GmbH has more than 500 employees, then it requires a supervisory board (Aufsichtsrat) in addition to its managing directors.

In the cases of company failure, the company’s liability is restricted to its assets and shareholders’ liability is limited to the amount of share capital invested. Shareholders’ personal property is protected.

Aktiengesellschaft (AG)

An AG is a German company which can trade on the stock market and offer its shares to the public. It requires at least 5 members and articles of association, authenticated by a court or notary, to set up with a minimum share capital of 50,000 euros.

An AG must have a managing board (Vorstand), empowered to decide all matters relating to the operation of the business and appointed by and answerable to the supervisory board (Aufsichtsrat). The shareholders of an AG exercise their power to control its policies at regularly scheduled general meetings (Hauptversammlungen).

kleine Aktiengesellschaft (AG)

The kleine Aktiengesellschaft is a mini version of the AG but with less regulation but a more complex registration process. You can set up the kleine Aktiengesellschaft as a sole shareholder but will require at least 3 people in your advisory board (Aufsichtsrat). Even for this form, you still need a minimum share capital of 50,000 euros.