The deadline, 30th June for filing your tax returns is fast approaching. Kama kawa, most of us are last minute people and those that just noticed they weren’t sure how to file the returns requested for this article. There are two methods for filing your taxes: those with an income and those without. So here goes.

Contents

When you have no income (Nil Return)

When you have no income you are still required to file a return with KRA. In this case you file a Nil Return. How to do that:

- Log into iTax with your PIN Number and password

- Click on the “Returns” Menu

- Pick “File Nil Return”

- Pick the type of Return,

- Enter your PIN

Select Tax Obligation: Resident, Non-Resident etc – KRA considers you are resident even if you were only in Kenya for one day in that year - Click Next

- Enter your PIN

- Enter the time period you would like to file the Nil Return for (this page has been changed, doesn’t look like the image below)

- Click Submit

- You get a confirmation that the Return has been filed and you can download the confirmation receipt

More details can be found at KRA.

When you have an income

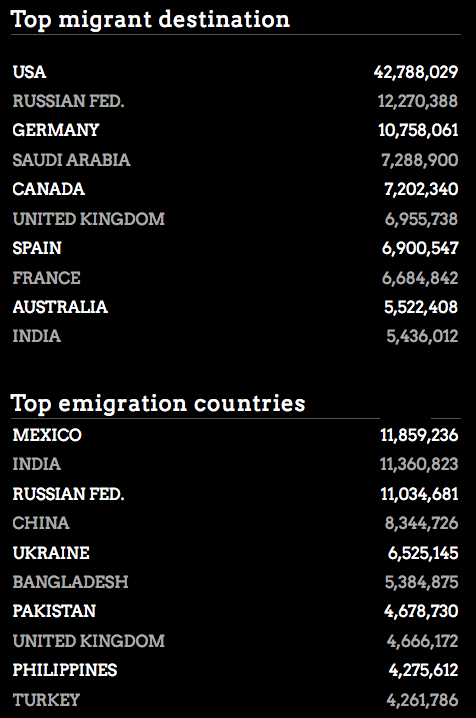

For those working in Germany and you have an income, this is the process to follow. The idea here is to confirm that you paid taxes. With the Tax Agreement between Kenya and Germany, you are required to pay taxes in at least one country. Filing this return, simply confirms to KRA that you have paid your taxes (for the income) in Germany and therefore should NOT be taxed in Kenya. If you have property or rental income in Kenya, that has to be taxed in Kenya.

How to do that, you can look at the instructions with pictures here: Filing Tax Returns for Kenyans in Germany

Step 0: Get on iTax

- Log into iTax with your PIN Number and password

- Click on the “Returns” Menu

- Pick “File Return”

- Download the Excel Sheet (either for Mac or PC)

- Start by reading the “Read me Page”, it gives instructions on how to enable macros

- After you have enabled the macros

Step 1: Start on Sheet A and enter your basic information:

- PIN Number,

- Return Period,

- to file your employment income in Germany, enter YES in row 7 where it asks “Do you have any income other than employment income?” Your employment income in Germany is entered as “Other income”. This is because your German employer does not have a KRA PIN and therefore cannot be entered in the space for employer in the Excel Sheet.

- Enter YES also to the question “Do you have an income from a foreign country?”

Step 2: Sheet B: Profit Loss Account_Self

- Total liabilities should be equal to Net Assets. Here you can enter 1 in the Assets and 1 in the liabilities for it to “break even”

- At the bottom, in the Other enter “Employment Abroad under” under “Name of Income”. If it is kawaida employment scroll to column H under “Other”, Enter zero for the others.

- Enter the amount you earned in Kenya Shillings. You should check what the exchange rate was at the end of that “Return Period”. So if you are doing returns for 2015, check what the exchange rate between the Euro and shilling were on 31st December 2015.

Step 3: Sheet T: Tax Computation

- We’ll go to this sheet twice, so don’t get confused when I mention it twice. In the file above there are also two images of it

- The first time you use this sheet is to check the amount of tax due to KRA, that will appear on C9. Compare this amount to the amount of taxes you paid in Germany. This is easy if you use your elektronische Lohnsteuerbescheinigung.

- Copy that amount onto a piece of paper. The sheet doesn’t allow you to copy.

Step 4: Sheet R: Double Tax Avoidance Agreement

- Enter the Document Reference Number for the DTAA for Germany which is 10419.

- If the amount you found on Sheet T in Step 3 above is below the amount of taxes you paid in Germany, which usually it is. Then you should enter that amount here as the “Amount of Tax Relief”.

- Realistically, you would enter the amount you paid in taxes in Germany, but because Germany charges higher taxes, you put the amount due in Kenya because KRA won’t refund the extra. If on the other hand, you are in a country that pays lower taxes, you would put that amount here and at the end of your tax return, the difference between what you paid in country X and the amount due at KRA, you would have to pay to KRA. But that doesn’t apply to Kenyans in Germany, so I won’t explain further lest I confuse you.

Step 5: Sheet T: Tax Computation

- Go back to Sheet T, and the amount you entered in Sheet R will now be reflected.

- Now scroll to the bottom of the page and click on VALIDATE

OPTIONAL: Errors

- After you click on validate, if there is anything you didn’t do right on the Excel sheet, then you will have a list of errors. The Errors will be on the “ERRORS” page. You will need to correct these before you can hand in your return, so work on them until you get no errors.

Step 6: Generate Upload File

- If you have no errors or have sorted them all out, then a dialoge box will appear asking if you want to generate an upload file. Click YES

Step 7: Zipfile Generated

- After you click YES, then another dialogue box appears this time explaining where to find your Zipfile. This is the file you need to upload on the KRA page.

Step 8: Upload

- Log back into iTax

- Click on the “Returns” Menu

- Pick “File Return”

- Enter Type of Return, Entity Type and Return Period

- In the “Upload From”, click on “Browse” and pick the zipfile that was generated

- Agree to Terms and conditions

- Click Submit