Most of us avoid doing our tax declaration thinking we might be forced to pay back huge sums. Surprisingly, the probability of you having to pay the government is much lower than them having to pay you back.

Unfortunately, employees in Germany only have until end of May to hand in their tax declarations and claim their refund from the state, the state however has until eternity. So if you owe the state money, not doing your tax declaration won’t help you. They are allowed to ask for their money back anytime they discover. You on the other hand, have until end of May to ask for your money from them.

Tax declaration simply means that having paid taxes throughout the year, you now declare what you actually earned in comparison to what you spent and if you spent more than you earned due to taxes, then you receive a refund. (Of course there are exceptions on what you spend money on, what taxes you paid for, your marital status, how many children you have etc)

So some tips for the employees:

Travelling costs

- Every employee is allowed to deduct their transport costs from their total taxable income. This is calculated as 30cents per kilometer between your workplace and your home. Those working a 5-Day-Week are assumed to travel 220-230 “rides” per annum while those with a 6-Day-Week 260-280 “rides” per annum

- Those who car-share may only have a maximum of €4500 as non-taxable. Those with their own cars have no upper limit.

- Those who fly to work also have a maximum of €4500

- Those who take the train to work also have no limit but require receipts for evidence

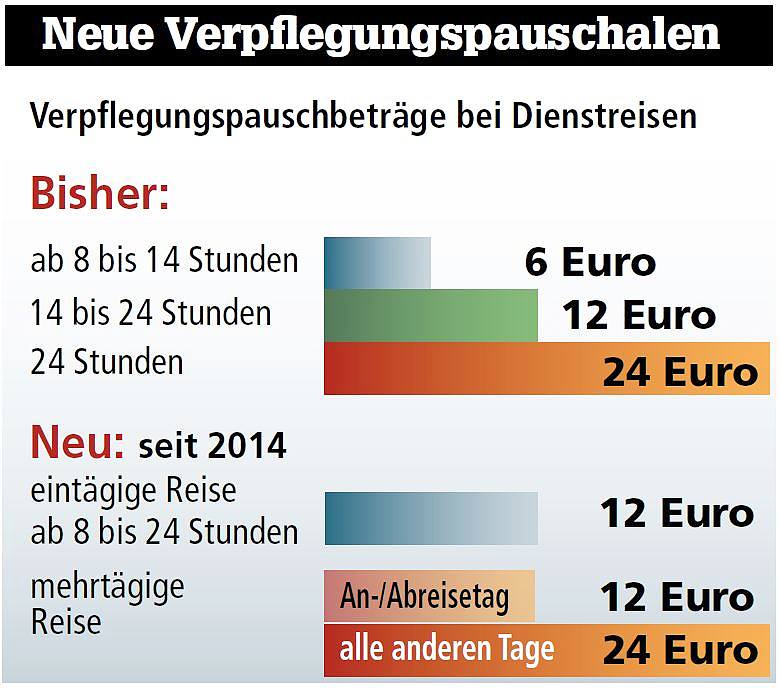

Business trips

Werbungskosten (Business Expenses)

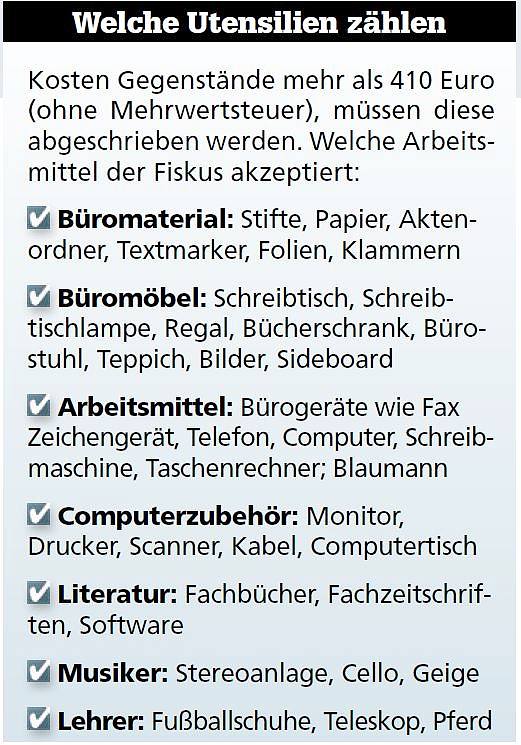

- This includes things you buy or pay for that help in doing your job.

- For anything that costs less than €487,90, you may include it as werbungskosten. Anything that costs more than that has to be “abgeschrieben” for a specific period e.g. computer/laptop 3 years and cell phone 5years.

- Some finanzamt recognize up to €110 as Werbungskosten without requiring evidence.

Internet and Telephone

- If you use your internet and telephone for work purposes then you can have 20% of the cost “abgesetzt” from your income.

Books and Magazine Subscriptions

If you have books and magazine you subscribe to that are solely for your education and/or for work purposes then you can have the costs recognised as Werbungskosten.

Arbeitszimmer (Study) vs Home-Office

- If you have a study or arbeitzimmer in your home, you are allowed to have them recognised as Werbungskosten. You’re allowed to calculate it at maximum, €1250 per annum. This applies to teachers who have to prepare for lessons at home or employees who need to write their work reports from home.

- A home-office on the other hand, has no limit. Assuming that you actually work in the home-office without having any other office elsewhere.

- This also applies to rooms that may have been rented that aren’t necessarily in your home e.g. a workshop, warehouse, sales-room e.t.c

- The cost of furnishing the room also falls under Werbungskosten

Second Home

- If you have to get a second home to be closer to the work place or to where you study, then that is also Werbungskosten.

- For the students, a room in your parents home may be considered but it has to be “separate” from their home i.e. you need to have your own address etc for it to be a second home to your hostel.

- Costs incurred in moving, renovation etc may be considered. A maximum of €1000 is accepted for rent per month.

- The second home should also reduce the travelling time by at least a half.

Studying

- A first degree, a Masters, MBA, Ausbildung, Language Course and even Fort and Weiterbildung are all considered Werbekosten.

Interested in reading more, check out Steuertips vom Focus Online.