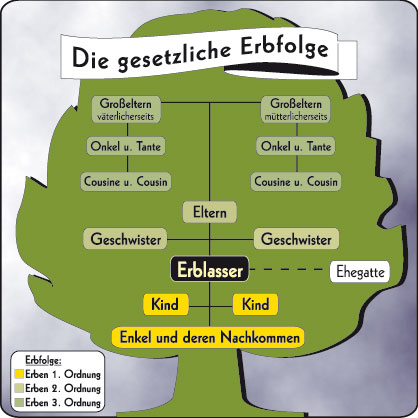

Unlike in Kenya law that generally regulates inheritance based on who inherits, German law regulates who is allowed to inherit what and when.

Subsequently, the law protects spouses and provides comprehensive legal procedures of how property should be handled after the death of a spouse.

The rules of inheritance/succession law apply if:

- There is no will

- The will is invalid

- The will does not cover the whole estate

If the deceased’s spouse is still alive at the time of the deceased’s death, the spouse’s share of the estate is to be determined first. According to § 1931 BGB the surviving spouse of the deceased is entitled to receive:

- 25% of the estate if there are any surviving children (or their issue) of the deceased

- 50% of the estate if the deceased is survived by his/her parents or their issue (i.e. sisters/brothers or nieces/nephews of the deceased) or grandparents

- 100% of the estate if the deceased is not survived by any of the aforementioned relatives

Property acquired during marriage

W.F. Frank & Partner Rechtsanwälte explain that under the German law the surviving spouse’s share is modified depending on the statutory “matrimonial property regime”.

They note that the regime outlines the minimum duties and rights of spouses in respect of the managing of assets and the administration of their estate.

There are three matrimonial property regimes under German law:

- Property regime of community of accrued gains (“Zugewinngemeinschaft” – § 1363 BGB ),

Unless stated otherwise in the prenuptial agreement, couples are automatically under the accrued gains regime. In this instance the spouses’ property acquired before marriage does not become common property. The same applies to property acquired separately during marriage. (§ 1363 Abs. 2 BGB)

In cases of death however, the surviving spouse inheritance increases by 25% of the interest earned by the property (§1931 Abs. 3, §1371 Abs. 1 BGB)

- Property regime of separation of property (“Gütertrennung” – § 1237 ABGB; § 1414 BGB) and

In case the couple chooses to separate their property by defining it in their prenuptial agreement, then the surviving spouse’s share of inheritance depends on the number of children (that inherit):

- If there is one child (or issue if predeceased), the spouse receives 50%

- If there are two children (or issue if predeceased), the spouse receives 30%

- If there are more than two children, however, the spouse’s share is 25%.

This property regime is only considered valid if the couple had mentioned it to an independent witness or had it registered in the local Matrimonial Property Register (Güterrechtsregister).

- Property regime of joint property (“Gütergemeinschaft“- § 1931 I and II BGB).

In the case of joint property provisions of § 1931 Abs 1 and 2 BGB apply without modification namely:

- 25% of the estate if there are any surviving children (or their issue) of the deceased

- 50% of the estate if the deceased is survived by his/her parents or their issue (i.e. sisters/brothers or nieces/nephews of the deceased) or grandparents

- 100% of the estate if the deceased is not survived by any of the aforementioned relatives

The deceased’s share in the joint property (Gesamtgut, § 1416 BGB) falls to his estate and is inherited according to the provisions of the law of succession (§ 1482 BGB).

The couple may also decide to continue to hold the joint property together even after death, in which case, the surviving partner and the person/s who inherit, continue to hold the property together. In such a case then only property that was separated may be inherited (§ 1483 I 3 BGB).