The German social system is under scrutiny again.

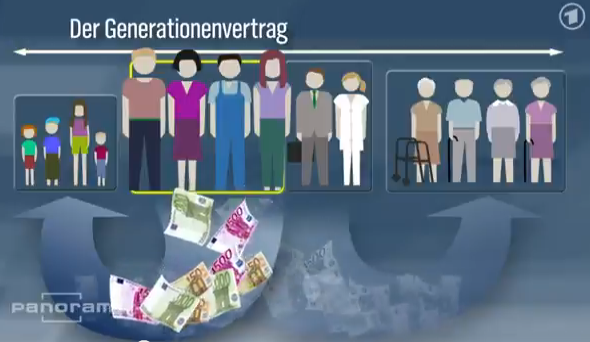

The issue this time is in relation to the “Inter-Generational Contract” (Generationenvertrag). The idea behind this system is that the working group pay taxes that go into paying pension for the older generation. This looks logical but there is a problem.

As a working individual in Germany, you pay taxes. Those with children pay even more taxes because they pay for both the old and the young. Those without children, don’t pay taxes for the children but their taxes go into the pension of the older generation. When these two groups grow old and the children are then paying taxes, both the group with children and those who never had children receive pension from the system. Those who had children receive less because they stayed home for a while to take care of the children while those who had no children receive more despite having paid less taxes.

Parents feel discriminated against because on having children, they spend more money on taxes yet when they are older receive less pension. The parents argue that it is unfair because they raise the children who pay the taxes needed in the pension. In essence, parents bring up children to pay pension for those who never had children.

Furthermore, single parents are even at a greater loss. According to research by the Bertelsmann Institute, 40% of single parents are on social welfare due to high taxes charged. “Policy has not been successful in improving the living situations of single parents,” head of the institute Jörg Dräger told the paper. “That’s a cause for concern – especially because the number of single parents has grown considerably.” Around 2.2 million children in Germany live in single parent households.

Those who consciously chose not to have children argue that parents shouldn’t complain that children are expensive. Having children is no duty to the state and every individual has a right to decide whether or not to have children. According to them, when someone buys a house, they never go around complaining how expensive the house is because they made that decision knowingly. Parents should do the same when it comes to their children.

But if everyone decided not to have children, who would pay for the pension of these groups when they grow old? Is it fair that parents live in poverty in their old age despite being responsible for “producing” the tax payers? Is it fair that those who don’t have children pay lower taxes yet enjoy higher pension?